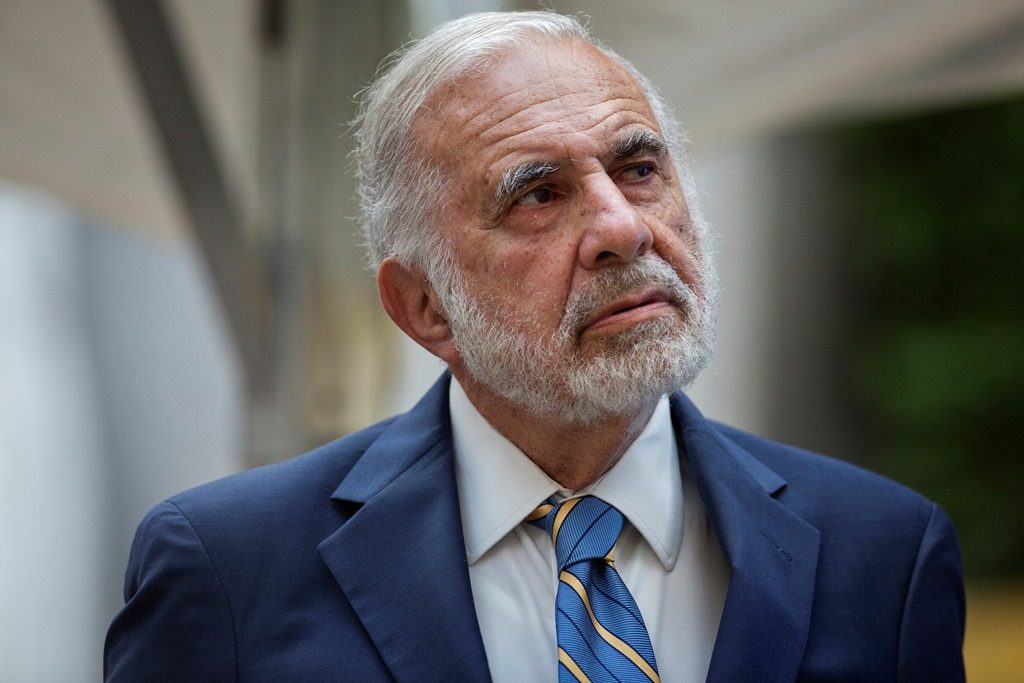

According to a report by Forbes on Monday, billionaire investor Carl Icahn has disposed of his stake in American International Group Inc (AIG).

AIG shares closed higher for a second consecutive trading session on Monday. The stock went up 0.83% ($0.44) to $53.28, after touching an intraday high at $53.68, or a price level not seen since May 2nd ($55.95).

In the week ended on May 6th the shares of the insurance company lost 6.06% of their market value compared to a week ago, which marked the worst performance since the week ended on November 6th 2016.

However, due to the recent string of gains, the stock has pared its loss to 4.86% so far during the current month, following a 2.90% surge in April. The latter has been the second gain out of six months.

For the entire past year, the shares of American International Group fell 8.77%, following a 5.39% surge in 2016.

According to Forbes, the activist investor sold out at a time when AIG shares traded at levels between $60 and $65, or prices not seen since late February.

Meanwhile, according to a report by Reuters, at a price level of $65 per share, Icahn would have been in possession of a $2.78 billion stake in American International Group.

Icahn initially started investing in AIG back in 2015, while, as of the end of 2017, he was the third largest shareholder in the US insurance giant holding a stake of 4.76%, Thomson Reuters data showed.

According to CNN Money, the 15 analysts, offering 12-month forecasts regarding AIG’s stock price, have a median target of $70.00, with a high estimate of $77.00 and a low estimate of $55.00. The median estimate is a 31.38% surge compared to the closing price of $53.28 on May 7th.

The same media also reported that 11 out of 20 surveyed investment analysts had rated AIG’s stock as “Buy”, while 8 – as “Hold”.

Daily and Weekly Pivot Levels

With the help of the Camarilla calculation method, today’s levels of importance for the AIG stock are presented as follows:

R1 – $53.43

R2 – $53.58

R3 (Range Resistance – Sell) – $53.74

R4 (Long Breakout) – $54.19

R5 (Breakout Target 1) – $54.73

R6 (Breakout Target 2) – $54.98

S1 – $53.13

S2 – $52.98

S3 (Range Support – Buy) – $52.82

S4 (Short Breakout) – $52.37

S5 (Breakout Target 1) – $51.83

S6 (Breakout Target 2) – $51.58

By using the traditional method of calculation, the weekly levels of importance for American International Group Inc (AIG) are presented as follows:

Central Pivot Point – $53.07

R1 – $56.56

R2 – $60.29

R3 – $63.78

R4 – $67.28

S1 – $49.34

S2 – $45.85

S3 – $42.12

S4 – $38.40