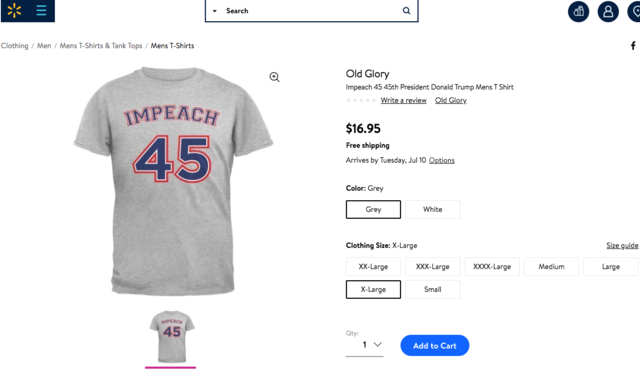

Walmart Inc (WMT) has reportedly removed the controversial anti-Trump “Impeach 45” clothing from its website after a number of users expressed their discontent on Twitter.

Walmart shares closed higher for the fifth time in the past nine trading sessions in New York on Tuesday. The stock went up 0.52% ($0.44) to $84.44, with the intraday high and the intraday low being at $85.05 and $84.09 respectively.

Shares of Walmart Inc have retreated 14.49% so far in 2018 compared with a 1.48% gain for the underlying index, S&P 500 (SPX).

In 2017, Walmart’s stock surged 42.87%, thus, it outperformed the S&P 500, which registered a 19.42% return.

The chairman of the group Students for Trump, Ryan Fournier, was among the first users to find out the clothing item was being sold by the retail chain, the International Business Times reported.

“What kind of message are you trying to send?”, Fournier asked in a tweet.

“I didnt want to believe it. So I searched for myself. This is despicable. All American Walmart? Im out!!!”, another user said in a post on the social network.

“These items were sold by third party sellers on our open marketplace, and were not offered directly by Walmart”, a spokesperson for the retail chain said in a response, cited by Fox News.

“We’re removing these types of items pending review of our marketplace policies”, the person added.

According to CNN Money, the 28 analysts, offering 12-month forecasts regarding Walmart Inc’s stock price, have a median target of $93.00, with a high estimate of $108.00 and a low estimate of $85.00. The median estimate represents a 10.14% upside compared to the closing price of $84.44 on July 3rd.

The same media also reported that 16 out of 31 surveyed investment analysts had rated Walmart Inc’s stock as “Hold”, while 11 – as “Buy”.

Daily and Weekly Pivot Levels

With the help of the Camarilla calculation method, todays levels of importance for the Walmart stock are presented as follows:

R1 – $84.53

R2 – $84.62

R3 (Range Resistance – Sell) – $84.70

R4 (Long Breakout) – $84.97

R5 (Breakout Target 1) – $85.28

R6 (Breakout Target 2) – $85.40

S1 – $84.35

S2 – $84.26

S3 (Range Support – Buy) – $84.18

S4 (Short Breakout) – $83.91

S5 (Breakout Target 1) – $83.60

S6 (Breakout Target 2) – $83.48

By using the traditional method of calculation, the weekly levels of importance for Walmart Inc (WMT) are presented as follows:

Central Pivot Point – $85.87

R1 – $87.27

R2 – $88.88

R3 – $90.28

R4 – $91.67

S1 – $84.26

S2 – $82.86

S3 – $81.25

S4 – $79.63