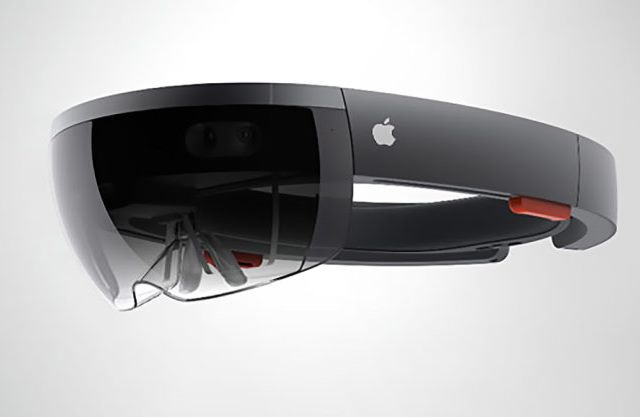

A new report from noted Apple analyst Ming-Chi Kuo showed that the tech giant had been developing an augmented reality headset and was poised to launch the product.

The pair of glasses could enter mass production as early as the fourth quarter of 2019 and could hit stores during the first half of 2020, the report said.

Apple shares closed higher for the seventh time in the past twelve trading sessions on NASDAQ on Friday. The stock edged up 0.24% ($0.41) to $172.91, after touching an intraday low at $169.81, or a price level not seen since February 19th ($169.49).

Shares of Apple Inc have added 9.62% to their value so far in 2019 compared with a 9.42% gain for the benchmark index, S&P 500 (SPX).

In 2018, Apple’s stock went down 6.79%, thus, it underperformed the S&P 500, which registered a 6.24% loss.

According to Ming-Chi Kuo, Apple’s augmented reality headset is expected to function more or less like an Apple Watch, while users will need to combine it with their iPhone device in order to fully use its features.

The pair of glasses will function as a deported display, giving users information right in front of their eyes. At the same time, their iPhone will take care of activities such as internet connectivity, location services and computing.

However, Kuo did not specify what the headset would include. According to TechCrunch, Apple could embed displays and sensors in order for the AR headset to be aware of users’ surroundings.

According to CNN Money, the 32 analysts, offering 12-month forecasts regarding Apple Inc’s stock price, have a median target of $175.00, with a high estimate of $245.00 and a low estimate of $140.00. The median estimate represents a 1.21% upside compared to the closing price of $172.91 on March 8th.

The same media also reported that 20 out of 40 surveyed investment analysts had rated Apple Inc’s stock as “Hold”, while 16 – as “Buy”. On the other hand, 1 analyst had recommended selling the stock.

Weekly Pivot Levels

By using the traditional method of calculation, the weekly levels of importance for Apple Inc (AAPL) are presented as follows:

Central Pivot Point – $173.49

R1 – $177.17

R2 – $181.43

R3 – $185.11

R4 – $188.79

S1 – $169.23

S2 – $165.55

S3 – $161.29

S4 – $157.03