Forex Trading Strategy – combining SMA, EMA and Moving Average Convergence Divergence

You will learn about the following concepts

- Indicators used with this strategy

- Signals to be looking for

- Entry point

- Stop-loss

- Profit target

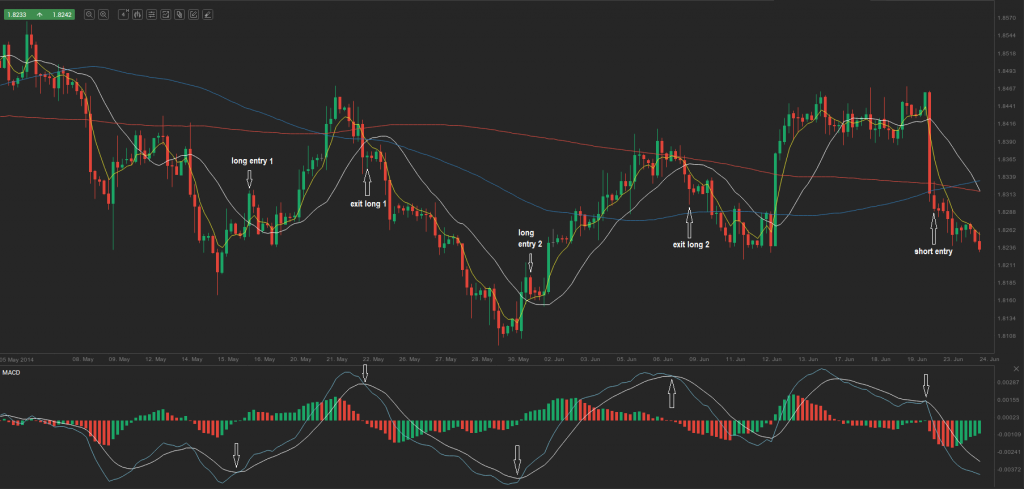

For this strategy we will be examining the 4-hour chart of GBP/CAD. The indicators we will be using are: a 100-period Simple Moving Average (SMA) (blue on the chart below), a 200-period SMA (red on the chart), a 15-period SMA (white on the chart), a 5-period Exponential Moving Average (EMA) (yellow on the chart) and the Moving Average Convergence Divergence (MACD) (with settings short term – 12; long term – 26; MACD SMA – 9).

A trader should make a long entry once: first, the 5-period EMA crosses the 15-period SMA from below to the upside, while the current candle has already closed; and second, the two lines of the MACD also cross, while the current candle has already closed. The cross of the MACD lines can occur earlier than the cross of the 5-period EMA and the 15-period SMA, or right after it. However, no more than 5 candles must be present between the two crosses. The trader should abstain from making an entry, if the two crosses are not present. The protective stop should be placed at the closest level of support, but the distance should not be less than 40-45 pips. This is used as a precaution in case a sudden huge move occurs. In other cases the stop will not be triggered, because the trader will have already closed his/her position.

The trader should exit his/her position only when two crosses (opposite to those mentioned above) are present. If only one cross occurs, the position should remain active.

The trader should make a short entry once: first, the 5-period EMA crosses the 15-period SMA from above to the downside, while the current candle has already closed; and second, the two lines of the MACD also cross, while the current candle has already closed. The protective stop should be placed at the closest level of resistance, but the distance should not be less than 40-45 pips.

A position should not be taken, when the price is at a distance of less than 25 pips from the 100-period SMA or the 200-period SMA. On the other hand, if the price crosses either the 100-period SMA or the 200-period SMA, the trader should enter the market, but only after the current candle closes on the opposite side of the simple moving average.