Forex boasts a daily trading volume of $4 trillion on average, which makes it the largest and most liquid financial market in the world. However, there is no central marketplace for foreign exchange trading. Each trader must choose a brokerage on their own.

The good news is there are lots of brokers out there, offering different possibilities and services to Forex traders. You have to ensure you make the best possible decision when choosing where to take your trades.

This article can help you make a reasonably informed pick. We cover everything you need to know, from the three main broker types and their most recognizable traits to the most common trading styles in Forex.

The 3 Main Types of Forex Brokers

As weird as this simile sounds, Forex brokers are like restaurants. New customers don’t just walk in immediately knowing what they are going to order. They have to inspect the menu first to see what dishes the eatery serves before they make a pick.

Things are quite similar with brokerage firms. At first glance, they all seem to offer the same basic services and products. Look closely at their “menus” and you would inevitably notice there are major differences in how they operate.

The type of broker you go for can have a significant impact on your Forex experience. Below are the three main types of Forex brokerages based on their principle of operation.

Market Makers aka Dealing Desk (DD) Brokers

The first thing you must pay attention to when checking out a Forex broker is whether it has a dealing desk. This term is a relic from the early days when financial institutions had actual desks staffed by analysts and dealers who would handle all the trading activities.

A Dealing Desk (DD) broker accepts trades from its customers without necessarily trading on the underlying markets. It provides liquidity to its clientèle and profits from the bid/ask spreads it builds into the trades.

Such brokers are called market makers because they literally make markets for their customers, contributing to the overall liquidity of the Forex industry. A market maker would often take the opposite side of its customer’s trade. While this looks like a conflict of interest, it is not.

Such brokers determine their own market prices, provide bid/ask quotes to traders, and fill their orders. They can afford to charge fixed spreads because the exchange rates of external liquidity providers are of no consequence to market makers. The decisions of individual customers are also inconsequential in this case. The customers have no direct access to the actual interbank market prices.

This should be no reason for concern, though. There is such a cut-throat competition between market makers that the price rates they set come shockingly close to the interbank market prices. Here is an example of how the entire trading process works.

Suppose you make a buy order for the GBP/USD pair for 100,000 units with a market maker. To fulfill this buy order, the market maker must first match it with a sell order from another customer. The other option is to transfer your GBP/USD trade to a liquidity provider who sells and buys assets.

This helps reduce the risk for the market maker because they profit from the bid/ask spread without actually taking the opposite side of the GBP/USD position (a process known as hedging). However, if the market maker fails to match your order, they will have no other option but to hedge against you.

Straight Through Processing (STP) Brokers

The second major category comprises No Dealing Desk (NDD) brokers. As the name implies, such brokerages have no dealing desks because they act as intermediaries between traders and other market participants, such as banks, hedge funds, mutual funds, other clients, and even other brokers.

Hedging is unnecessary in this case because NDD brokers receive their price quotes from the interbank markets. Customers’ orders are linked directly to the above-listed liquidity providers. NDD brokers typically charge their traders with nominal commissions when they enter a position. The other option is to add a markup to the position by tweaking the spread a little bit.

There are two types of NDD brokers, the first one being the Straight Through Processing (STP) type. Such brokers work with multiple liquidity providers who can directly access the interbank market. Respectively, each liquidity provider sets its own bid and ask prices.

Here is an example of how it works. Assume, for instance, your STP broker is connected to three different liquidity providers, each one offering different quotes for the GBP/USD pair like so:

| Liquidity Provider | Bid Price | Ask Price |

|---|---|---|

| Provider 1 | 1.3998 | 1.4001 |

| Provider 2 | 1.3999 | 1.4001 |

| Provider 3 | 1.4 | 1.4002 |

The STP broker’s system will organize the quotes of its three liquidity providers in ascending order, i.e. from the best to the worst prices. In this example, the most appealing bid price is 1.4000 because a trader wants to sell high. Meanwhile, the ideal ask price is 1.4001 because they will be looking to buy low. The best spread in this instance should be 1.4000/1.4001, which makes for a difference of 1 pip.

However, the STP broker will not offer you this spread. Instead, they will introduce a small markup (typically fixed) as a means of compensation. If we assume their policy involves a fixed markup of 1 pip, they will quote you at a rate of 1.3999/1.4002.

This way, the 1-pip spread would become 3 pips for you. Provided that you accept these rates and buy a lot of 100,000 units, the STP broker will route your order either to Liquidity Provider 1 or to Liquidity Provider 2.

If one of the two accepts the order, you will end up with a long position for GBP/USD at an ask price of 1.4002 while your liquidity provider will hold a short position at a bid price of 1.4001. The STP brokerage would register a 1-pip profit thanks to the markup. These adjustments to the bid/ask prices are the main reason why most STP brokerages offer flexible instead of fixed spreads.

Note that an STP broker can act as a market maker if they fail to find a counter-party for your order on the interbank market, i.e. the broker will match your trade within its own customer base and take a position that is opposite to yours.

Electronic Communication Network (ECN) Brokers

Electronic Communication Network (ECN) brokers also fall within the category of NDD brokers. The difference here is they allow their customers’ orders to interact with those of other participants in the electronic communication network.

These participants could be banking institutions, other retail traders, hedge funds, and other brokerage firms. All of those trade against each other by providing their own bid/ask rates. Because of this, ECN brokers do not take positions opposite to those of their traders. If the broker is unable to find a deal at the respective quoted price, they would either send the trader a requote or reject their order altogether.

Trading with an ECN brokerage requires a significant initial investment since most of these market participants only bother for bigger lots. Minimum accounts normally require a capital within the range of $1,000 to $50,000.

Another difference results from the fact ECN brokers give their customers access to Depth of Market, which shows you where the bid/ask orders of the other participants are. Since setting a fixed markup on trades is extremely difficult under these circumstances, an ECN broker would normally charge a small commission as well.

12 Essential Facets of a Good Forex Broker

Finding a decent Forex brokerage is further complicated by a broad range of options traders are faced with. There are hundreds, if not thousands, of brokers on the Internet. To make it easier for you, here are twelve things you need to have a look at when choosing your Forex broker.

Full Regulatory Compliance

Regulatory compliance is one of the first and most important things you need to take a look at. For example, a reputable US Forex broker will be a member of the NFA (the National Futures Association) and will also be officially registered with the CFTC (the Commodity Futures Trading Commission) as a merchant and dealer. Under local regulations, CFD trading is prohibited in the US.

Regulators work in the best interest of traders. They protect them from fraudulent companies and ensure a fair market environment for all participants. The thing about foreign exchange regulations, though, is that they vary wildly between different jurisdictions. Each country has its own financial regulator, tasked with the oversight of the Forex trading sector.

- The UK Forex market is scrutinized by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). The FCA imposes caps on maximum leverage and offers negative balance protection of up to £50,000 per customer. Clients’ funds are stored in segregated accounts.

- The market in Australia is overseen by the Australian Securities and Investments Commission (ASIC). In the fall of 2019, the agency unveiled plans to further reduce leverage caps and altogether ban trading with binary options.

- Canada Forex brokers must comply with the regulations of the Investment Information Regulatory Organization of Canada (IIROC). CFD trading is allowed in the Great White North but there are restrictions on the maximum leverage retail clients can use.

- Forex markets in the EU are regulated by the European Securities and Markets Authority (ESMA) under the provisions of the 2004 Markets in Financial Instruments Directive (MiFID), which aims to harmonize regulations across all EU member states. Leverage caps vary between different asset classes but the recommended maximum is 30:1 for major currency pairs.

- France’s foreign exchange industry is overseen by the Autorité des marchés financiers (AMF). The agency has already aligned its regulatory framework with the recommendations of ESMA, restricting leverage for retail customers to 30:1.

- Forex trading in Japan is subject to the scrutiny of the local Financial Services Agency (FSA). Japanese customers who trade on margin must comply with one of the lowest leverage caps in the world. The maximum is 25:1 for major pairs.

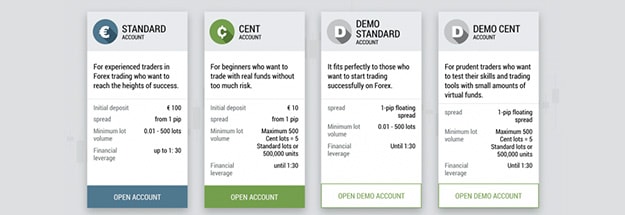

Versatile Range of Account Types

Pay serious attention to the range of available account types before you choose a broker. A good brokerage would normally provide its customers with a choice from several account types to meet the needs of different traders.

The types are usually based on customers’ experience level, their trading style, and the volume they intend to trade. For example, professional accounts often have higher caps on maximum leverage but require significant expertise and experience to open.

Interested customers must go through a brief questionnaire so the broker can establish whether they are competent enough to trade higher volumes professionally with more leverage. Minimum deposits are larger for such accounts and so are the trading lots.

Forex beginners, on the other hand, can take advantage of mini or micro accounts where they can start trading with a very small initial investment. Accounts can sometimes differ depending on the type of order execution, the most common example being the ECN account.

Demo accounts are usually available as well so clients can give the broker’s platform a test drive. These are also good for trying out new strategies since you use virtual credits instead of actual money.

Margin and Leverage

All Forex traders have access to different leverage caps depending on their jurisdiction and the brokers they trade with. Leverage can vary anywhere from 2:1 to 1000:1, sometimes even more. The caps usually differ based on the volatility of the respective asset class.

Leverage is basically a credit extended to you by your broker. It allows you to trade significant amounts with a relatively small initial investment. Let’s give a brief example with a 50:1 leverage. If you have $1,000 in your account’s balance, you can inflate the size of your trades to $50,000 thanks to the 50:1 leverage.

Remember to use leverage with caution. It has the potential to significantly boost your profits from small investments but it can also cause your losses to go way beyond your available balance.

Choose a broker whose leverage caps correspond to the trading volume you intend to invest. The leverage you take should also coincide with your individual risk tolerance. Professional traders often choose brokers with higher caps on maximum leverage. Retails customers are recommended to maintain lower levels of leverage.

Narrow Spreads and Low/No Commissions

Spreads and commissions are next on the list. All brokers out there profit from the spreads built into the bid/ask prices or by charging commissions on your trades. There are also firms that have no fixed commissions whatsoever but compensate for their absence by using steeper spreads.

Spreads are either fixed or float based on market volatility. Suppose, for instance, the pair GBP/EUR is quoted with a bid/ask price of 1.1535/1.1539, which corresponds to a spread of 4 pips. Thus, if a market participant buys it at 1.1539, the value of this position has already dropped by 4 pips because it could only be sold immediately at a price of 1.1535.

The rule of thumb is the greater the spread, the more difficult it would be to realize a profit. How frequently a given Forex pair is traded also plays a role. Typically majors like EUR/USD, EUR/GBP or GBP/USD have significantly tighter spreads than exotics like MXN/TRY, for instance.

Just like in school, it is important to do your homework and compare the costs at different brokerages. It is only natural to choose the company that offers you the lowest commissions and the best spreads.

Multiple Order Types

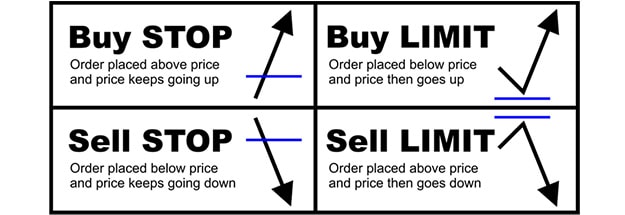

The best brokers on the Forex market facilitate multiple types of orders, with some of the most common options being market orders, limit orders, and stop orders. We explain each type in brief below.

- The market order is probably the most basic and widespread type in Forex trading. With this order, you enter a market immediately at the best price that is currently available. Note that sometimes there may be a discrepancy between the price at which you entered the order and the final price at which your order gets executed.

- The stop order turns into a market order once a currency pair reaches a given sell or buy price. You can use it to open a new position or to close an existing one. There are two subtypes of stop orders. The first one is the buy-stop order where you enter a market once its price reaches or exceeds your specified price. The second one is the sell-stop order, in which case you sell a Forex pair when its price reaches or drops below the price you have specified.

- A limit order is executed when you are looking to open a new position or close an existing one but only at a predetermined price or higher. Respectively, you again have limit-buy and limit-sell orders.

Fast Speed of Order Execution

The speed of order execution is of essential importance, even more for those who engage in day trading and place market orders. It is of utmost importance that your brokerage fills your orders with lightning speed at the best possible prices.

If order execution is slower, the prices might move a few pips until the broker fulfills the order, which reduces your chances of winning this trade. The average order speed at the best Forex brokerages is as fast as 0.001 seconds.

Multi-Feature Trading Platform

When it comes to Forex, trading activities normally happen via the brokerages’ trading platforms. All good brokers in this industry cater to customers with intuitive yet multi-feature platforms, the most commonly used ones being MetaTrader 4 and MetaTrader 5.

When choosing a Forex broker, make sure you check what features its platform supports. Some of the must-have functionalities you should look out for include charting and technical analysis tools, automated trading, real-time quotes, options for customization, multiple timeframes, trading through charts, different types of order execution, and backtesting. Multi-language support is always a plus.

Rich Selection of Forex Pairs and Financial Instruments

There will come a time when you start considering portfolio diversification. Because of this, it is essential to find a broker that offers a rich selection of currencies pairs that spans all minors, majors, and exotics.

The best Forex brokers out there usually offer more than 50 currency pairs along with a variety of other financial instruments including shares, indices, bonds, futures, options, cryptocurrencies, and commodities. The ability to invest in several markets is always beneficial from the perspective of versed traders.

No Limitations on Trading Styles

The best brokers out there never restrict their customers in terms of trading styles. When choosing a brokerage, you should take your trading style into account. Always consider your style before you make a pick, including your trading frequency and the length of your trades (long-term versus short-term).

If you are a scalper, for example, be sure to pick a brokerage that enables you to practice this technique and uses an ECN platform. Provided that you prefer day trading, the premium should fall on qualities like high speed, narrower spreads, and reliability.

Forex Education Tools

The availability of various tools for learning and education is a facet brokers who care about their customers commonly share. Educational materials are especially beneficial to Forex beginners and can greatly improve their learning curve.

It is essential for novices to gain a proper understanding of trading terminology, so a brokerage with educational tools is inevitably the better choice. Some Forex brokerages cater to customers with dedicated training courses. Others offer detailed explanatory videos or host specialized online webinars you can participate in at no cost. Remember that adequate education enables traders to generate more profits with less effort.

Varied Deposit and Withdrawal Options

It is always nice to have a varied choice where payments are concerned. When choosing a Forex broker, be sure to check what methods it supports for deposits and withdrawals. The most common options you are likely to encounter include standard bank transfers, credit and debit cards, and online banking.

Many brokerages also accept payments via popular e-wallets such as PayPal, Skrill, WebMoney, and Neteller. The best brokers in the industry support country-specific methods to the benefit of customers from different jurisdictions.

Also important is to check the transactional costs and the processing timeframes of the brokers you are interested in. Some companies tend to handle payments faster than others. Good brokerages would rarely charge customers on their money transfers.

Traders whose live accounts remain inactive for a specific period (typically three to twelve months) normally have to pay nominal monthly fees for maintenance. We suggest you pick a company that offers negative balance protection if you intend to trade on margin and leverage your positions.

A reliable and well-regulated broker would inevitably adopt a segregated-account policy. This is to say customers’ funds are kept in separate accounts to protect them in case the trading company enters insolvency.

Prompt and Efficient Customer Support

Customer service is another aspect you need to take care of. Usually Forex trading occurs 24 hours a day from Monday to Friday. This is why the broker you choose should offer 24/7 customer support.

Another thing is that the staff has to be professional so that a person will not have any problems communicating with them. When considering your future broker, make a quick call and check the customer service. It tells a lot about the broker.

The competence of the support representatives when handling account-related or technical issues is just as essential as the brokers’ performance in terms of trade execution. All major firms provide multi-language customer support via email, dedicated live chat, and telephone. If this is your first time opening a trading account, the support staff would be more than happy to walk you through the entire registration process.

Your Trading Style Must Be Factored In

The trading strategy you intend to use can assist you in choosing a Forex broker. Strategies and trading styles are typically based on how long a trader holds their positions open, how frequently they open new ones, and how they time their market entries and exits.

For example, long-term position traders who open new positions infrequently are recommended to choose brokerages that provide more information, news calendars, and adequate educational tools. Such traders should not necessarily look for brokers with very competitive spreads for the simple reason they are not trading as often.

On the other hand, customers who trade actively with short-term positions are much more sensitive to spread breadth. Below, we cover five of the most common trading styles in brief. Check them out to see whether you can recognize yourself.

- Day trading is a popular style where traders close out their positions within the same day they have opened them. Multiple currencies are bought and sold within a span of 24 hours. While day trading can encompass a broad range of strategies, the main benefit here is that one avoids the additional risk associated with holding their positions overnight. Forex brokers with ultra-tight spreads are the best choice for such active traders.

- Scalping is another short-term style adopted by people who actively trade currency pairs. The goal here is to realize small but consistent profits by quickly entering and exiting the Forex markets.

Scalpers rely on the subtle changes in prices. An adequate exit strategy is of utmost importance in this case. A larger loss could entirely wipe out the small profits you worked hard to accumulate. Tight spreads are very desirable from a scalper’s perspective. - Swing trading is a momentum-based style of trading where a trader buys low and sells high. Positions are held either for a short or a long time, but typically no more than several days, weeks or months. Swing traders commonly rely on tools for technical analysis to explore trends and patterns in Forex price movements. Some prefer to use a combination of technical and fundamental analysis.

If you plan to swing trade, you are better off with a broker whose platform supports a broad range of technical indicators. Support and resistance levels are also important to swing traders. Narrow spreads are not as essential because such traders tend to open positions less frequently. - Trend trading is pretty much what its name implies. Trends are observed when the prices of currency pairs move consistently in one direction, either up or down. A trend trader’s goal is to try and capitalize on this momentum. One such person would commonly implement trailing stop orders to protect their gains. Broader spreads are not such an issue in this case since such traders only open positions occasionally.

- The saying “No news is good news” does not ring true when it comes to Forex trading. News stories cause currency prices to move and contribute to market volatility. News reports are so important that they have given rise to an entire style called news trading. It involves taking advantage of the volatility created by important news releases. Such traders are into brokers that provide good financial news feeds and busy economic calendars.