Failed breakouts from trend channel lines

This lesson will cover the following

- Trend channel line overshoots as signals

- An example

It is worth noting that the trend channel line may not be apparent when the reversal takes place. As soon as the move begins to show a more parabolic shape, traders on price action will usually redraw trend channel lines in search of an overshoot and a reversal. The most reliable reversal setups have huge reversal bars and provide opportunities for second entries. The first leg of a reversal will very often move through a trend line. If it fails to do so, an actual reversal may not occur and a trading range or trend continuation becomes a greater possibility. In case the second entry in the reversal turns out to be a failure, the original trend is very likely to continue and last for at least two legs.

Traders against the trend will almost always draw trend channel lines in anticipation of an overshoot and then a reversal, which will enable them to scalp. A preferable scenario for them would also be a two-legged move in the opposite direction to that of the trend.

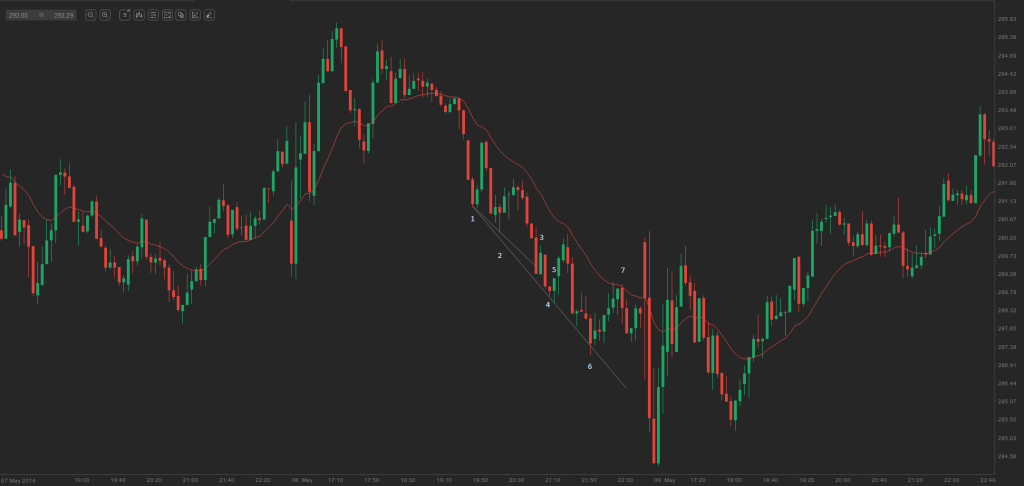

On the 5-minute chart of AMZN above bar 3 breached a short trend channel line in the downtrend, but no previous countertrend strength was present. In this case cunning price action traders would have instead waited for a secondary entry and if such did not appear, they would have considered this as a setup to enter in the direction of the trend (and it appeared to be so). Bar 6 overshot a larger trend channel line and the signal bar for an entry against the trend was an inside bull trend bar with a good-sized body, therefore, many traders would have viewed this setup as an opportunity for a successful countertrend scalp. Bar 7 was a good M2S setup, which offered an opportunity for a with-trend entry.