Weve already established the differences between fundamental and technical analysis in the previous section. Now its time to talk in more detail about technical analysis and one of its defining characteristics – the search and identification of trends.

Trends are one of the most crucial analytical units in technical analysis. Spotting them is one of the main objectives of the process, hence their huge importance is simply undeniable. Even so, the idea is not all that difficult to explain. Trends in finances are not all that different from trends in the general sense of the word. What it really means is the overall direction where something (in this case the market) is headed. You can clearly see the trend in the following example:

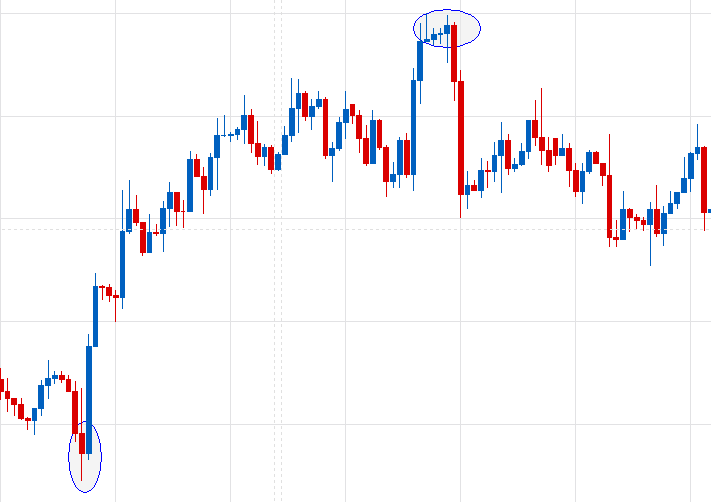

However, keep in mind that its not always as easy to spot a trend as you might be led to believe. Thats why a proper skill set and lots of training is needed before you will be competent enough to identify a trend in normal circumstances. Heres another example of a trend in a more natural environment. As you can see, you cant tell it right away.

Some charts offer you lots of information about the security, but hardly where its headed. Additional training and research are needed before one is able to spot trends by simply looking at a chart. Sometimes, additional information about the market environment as well as the characteristics of the asset are also need if you hope to identify a trend.

A More Formal Definition

You already know that spotting a trend isnt as easy as it may look at the first glance. By looking at a chart, you will notice that the numerical values of the price of an asset never go in only one direction and always have some sort of fluctuations. This means that we cant identify a trend on the sheer price movements in a direction; instead, we look the series of highs and lows the prices go through during their movement and this is how we determine a trend in the financial sense of the word.

To give you an example, an uptrend would represent higher highs and higher lows in a series of numerical progressions and will tell us that there is an overall rise in the price of the asset. If it keeps the same direction, then we have a trend. The situation with the downtrend is the polar opposite – we get lower highs and lower lows but its still easy to identify.

As you can see in the example, we have a progressive series of highs and lows and its clear that the overall price of the asset is going up. The trend keeps up as long as each low is higher than the one before. If the successive low is lower than the one that preceded it, then we are talking about trend reversal.

Types of Trends

The types of trends we know are three. You already know about uptrend and downtrend. In the uptrend, each successive low is higher than the one before it, which means we are talking about an overall upward direction of movement, hence the name. In the downtrend, each successive high is lower than the one before it, which means that the overall direction is downward. There is a third type of trend we havent talked about yet, and that is the sideways trend (also known as horizontal trend). There has been some dispute as to the validity and existence of such trends at all.

While some traders consider them an important part of the decision making process, others think that there should be no existing definition for those trends because they are more technically a lack of trend. Unlike the uptrend and downtrend, the horizontal trend offers little to no movement (which is why some traders dont consider it a trend). Its a moment of stability. Whether you think its a trend or the lack of thereof, its important to acknowledge when the market reaches an episode of stagnation.

The Importance of Trends

Identifying and using trends to a traders advantage is one of the most important aspects of trading. Even though it may sometimes be complicated, the process of spotting and properly trading based on a trend is in the heart of the successful business transaction. Technical analysis relies heavily on the analysts ability to perform those duties well and even though it may not seem like it sometimes, if you manage to identify a trend and use it, you can make a lot of money (even though there are still risks).